Identifying High-Commercial-Value Keywords in 2026: A Cross-Industry Analysis

Expert reviewed

What counts as "high-commercial-value" in 2026 (and why CPC is only one signal)

High-commercial-value keywords are not "the highest volume keywords." In 2026, they are the queries most tightly connected to revenue outcomes: demos, quotes, contact forms, purchases, and qualified pipeline. Most of these are buyer intent keywords that sit in commercial investigation or transactional intent.

Here are the most reliable signals to look for (in priority order):

- Clear action language: "pricing," "quote," "demo," "book," "near me," "implementation," "agency," "service."

- Tight problem-solution fit: the query describes a specific scenario your offer actually solves (often converts better than generic "software" head terms).

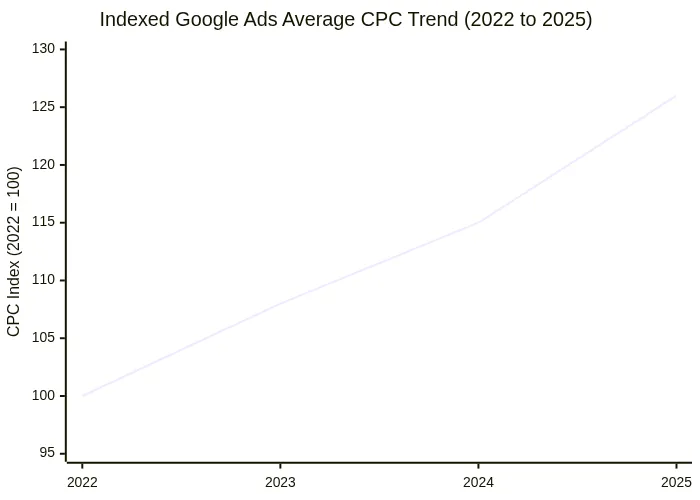

- High or rising CPC (contextualized): CPC is a proxy for advertiser competition and perceived value, but it can be distorted by hype or poor bidding. Use it as a clue, not the final answer. Benchmark studies show CPC rising broadly, making organic capture more economically meaningful than it used to be.

- Downstream quality: higher MQL to SQL rates, shorter sales cycles, higher close rates, higher CLV.

- SERP "money intent" patterns: shopping modules, local packs, "best/compare" listicles, pricing pages, strong ad density.

In parallel, AI-augmented search is compressing the discovery funnel. Some queries get answered directly on the results page, so structure, clarity, and authority matter more for being cited or surfaced. Google explicitly points to clear headings, helpful structure, and quality signals for strong performance in AI results (Google Search Central guidance). Semrush's analysis also suggests top organic positions are more likely to be included in AI Overviews (Semrush AI search study).

Cross-industry context: CPC is rising, so buyer-intent SEO is becoming more valuable.

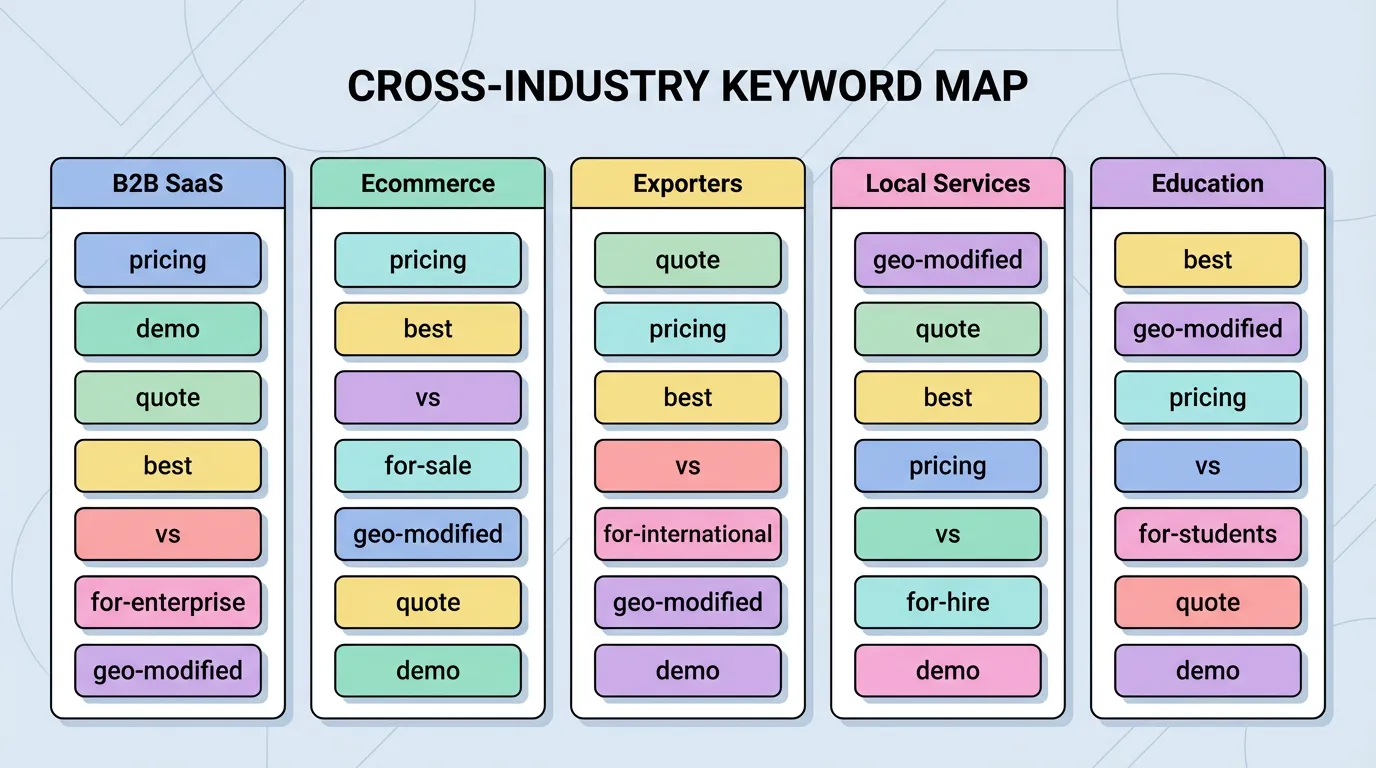

Cross-industry buyer-intent patterns: 15 keyword types that consistently drive revenue

Use this list as a "pattern library" across B2B SaaS, ecommerce, exporters, local services, and info products. The goal is to identify revenue-driven SEO keywords that map cleanly to a page you can rank and convert with.

1) Pricing and cost-intent modifiers (BOFU)

- Examples: "[service] pricing," "cost of [solution]," "[product] price," "implementation cost."

- Why it works: direct budget intent, often fewer window shoppers.

2) Quote, demo, and consultation modifiers (BOFU)

- Examples: "get a quote," "request demo," "book consultation."

- Works especially well for: B2B services, SaaS, exporters, local services.

3) "Best" and "top" evaluation queries (MOFU)

- Examples: "best [category] for [use case]," "top [service] provider."

- These are classic buyer intent keywords, but they require credible comparisons and strong page structure.

4) "Vs" and comparison queries (MOFU)

- Examples: "[vendor A] vs [vendor B]," "[approach] vs [approach]."

- Best practice: build a fair comparison and route users to the most fitting next step.

5) "For [industry/role]" vertical modifiers (MOFU to BOFU)

- Examples: "CRM for manufacturing," "SEO for exporters," "project management software for construction."

- Why it works: higher fit, higher conversion, usually lower competition than head terms.

6) Use-case and scenario queries (often highest lead quality)

- Examples: "[solution] for reducing returns," "[service] for fixing indexing issues," "supplier for custom MOQ."

- Practitioner research consistently finds problem-oriented terms can outperform generic category terms when matched to the right landing page and proof.

7) Geo-modified service queries (BOFU, local-heavy)

- Examples: "[service] in [city]," "near me," "emergency [service]."

- Often the highest CPC and strongest conversion in local services categories (Search Engine Journal benchmarks discussion).

8) Attribute-rich ecommerce modifiers (BOFU)

- Examples: "buy [product] size 10," "best [product] for flat feet," "[material] [product] review."

- Mid-funnel buying guides frequently monetize well when internal linking pushes to product and category pages.

9) Compatibility/part-number queries (BOFU, ecommerce)

- Examples: "fits [model year]," part numbers, specific compatibility strings.

10) Compliance/certification modifiers (exporters and regulated verticals)

- Examples: "ISO certified," "FDA compliant," "HS code," "incoterms."

- Often low volume, very high deal value.

11) "Agency" and "service provider" queries (BOFU for B2B services)

- Examples: "technical SEO audit service," "SEO content strategy agency," "hreflang SEO consultant."

12) "Alternative to" queries (MOFU)

- Examples: "alternative to [vendor]," "switch from [tool]."

- Strong evaluation intent, but you must be honest and specific.

13) Review queries (MOFU, credibility-driven)

- Examples: "[brand] reviews," "[course] review."

- Requires robust trust signals and transparent positioning.

14) Purchase-ready verbs (BOFU)

- Examples: "buy," "order," "book," "sign up."

- More common in ecommerce and info products.

15) "Fast" or urgency modifiers (BOFU)

- Examples: "same-day," "emergency," "24/7."

- Particularly powerful in local services.

A practical scoring model for high CPC keywords analysis (without chasing vanity terms)

A common failure mode in commercial keyword research is over-weighting CPC or volume and under-weighting conversion reality. Use a simple scorecard that forces tradeoffs.

Step-by-step workflow (listicle format)

- Pull candidates from multiple sources

- Search performance data (impressions and queries where you already "almost rank").

- Paid search terms (what already converts at a known cost).

- SEO tools for CPC and difficulty estimates.

- Sales and support language (how customers describe problems).

- Label intent and funnel stage

- Separate TOFU education from MOFU evaluation and BOFU action.

- Buyer intent keywords should cluster in MOFU to BOFU, not purely TOFU.

- Group into clusters, not single terms

- One BOFU page should be supported by MOFU comparisons and scenario pages.

- This also helps AI systems extract and cite your content when it is well-structured (Google Search Central).

- Score each cluster using a weighted rubric

- You can do this in a spreadsheet in under an hour and iterate monthly.

Keyword cluster scoring rubric (example)

| Factor | What to check | Why it matters in 2026 | Suggested weight |

|---|---|---|---|

| Intent strength | Pricing, quote, demo, near me, provider | Direct revenue proximity | High |

| CPC signal | Relative CPC inside the cluster | Commercial pressure and cost-avoidance opportunity | Medium |

| Conversion evidence | Paid CVR, lead quality notes, assisted conversions | Prevents "high CPC, low revenue" traps | High |

| CLV alignment | High-value service lines, strategic regions | A few wins can fund the program | High |

| SERP feasibility | Format match, competition level, SERP features | Determines time-to-impact | Medium |

| Technical readiness | Can the target page be crawled, indexed, fast, structured | Content cannot win if pages are broken | High |

Quick "do this, not that" for CPC-led prioritization

- Do this: "Moderate CPC + very specific scenario + strong conversion evidence."

- Not that: "Extreme CPC head term + vague intent + no proof it closes."

If you need a sanity check on what "good" looks like across industries, use benchmark references as directional context, not absolute truth.

Turning revenue-driven SEO keywords into pages that rank: the technical checklist most teams miss

Even the best commercial keyword research fails if BOFU pages are slow, blocked, or semantically unclear. This is where SeekLab.io's audit-first approach matters: don't aim to fix everything, focus on what truly impacts growth and what can be deprioritized.

Use this checklist to make buyer-intent pages "search-ready" and "AI-answer-ready":

1) Crawlability and indexation for money pages

Prioritize service, product, pricing, quote, and demo pages:

- Not blocked by robots.txt.

- Not accidentally noindexed.

- Canonicals point to the correct URL (not to a generic category).

- JavaScript rendering does not hide core content from crawlers.

2) Site architecture and internal linking (reduce "distance to money")

A practical rule: BOFU pages should be within 2 to 3 clicks from the homepage and supported by contextual links from relevant guides and comparisons.

Internal linking map example (simple but effective):

- TOFU guide: "how to solve X"

- Links to MOFU: "best solutions for X"

- Links to BOFU: "pricing," "quote," "contact"

- Links to MOFU: "best solutions for X"

3) Core Web Vitals and page performance

Buyer-intent clicks are expensive to earn. If the page is slow or unstable, you leak revenue.

- Improve LCP, CLS, and INP on your highest-intent landing pages first.

- Optimize mobile UX, because many high-intent searches (especially local) are mobile-heavy.

4) Schema and structured content for richer SERPs and AI extraction

Structured markup and clean heading hierarchy help engines interpret your offer:

- Use relevant schema types (Service, Product, FAQ, Organization, LocalBusiness, Review, Course where applicable).

- Keep headings aligned to intent: "Pricing," "What's included," "Timeline," "FAQ," "Case examples."

For teams planning around AI Overviews and other answer experiences, prioritize clarity, entity consistency, and verifiable claims. This aligns with Google's guidance on succeeding in AI results.

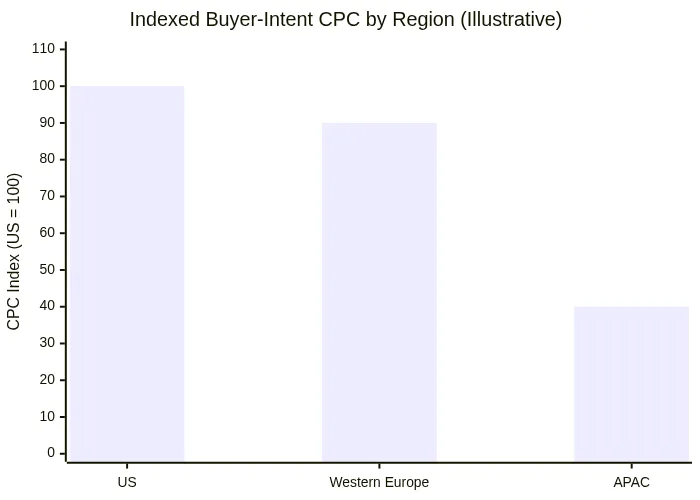

International and cross-market deployment: how to localize buyer intent without diluting authority

For APAC, the US, and Europe, the same "English keyword list" rarely works as-is. Buyer intent changes by language, trust expectations, and compliance context.

Use this localization checklist:

- Do not translate intent literally

- Translate scenarios and buying language, not just words.

- Validate with sales, BD, and support: "What would a qualified buyer actually type?"

- Build market-specific BOFU pages

- Separate pages for different regions if the offer, proof, or compliance differs.

- Add local proof points (case context, fulfillment, lead times, certifications).

- Use hreflang correctly to prevent cannibalization

- Especially for English variants (en-US vs en-SG vs en-GB) and multilingual stacks.

- Consistent URL patterns make it easier to scale and maintain.

- Expect attribution limitations

- Privacy and consent restrictions can blur keyword-to-revenue mapping, especially in Europe.

- Track directional performance at the cluster and landing-page level, not only per-keyword.

Regional CPC reality check (directional index)

Multiple benchmark sources suggest Tier-1 markets tend to be more expensive, pushing some advertisers toward Tier-2 and Tier-3 for ROI.

What to measure monthly (so "commercial keyword research" actually turns into leads)

To keep SEO revenue-aligned in 2026, measure outcomes in layers:

- Visibility (leading indicators)

- Impressions and rankings for buyer intent keywords by cluster.

- Presence in SERP features that dominate commercial clicks (local pack, shopping, FAQs).

- Engagement and conversion (core)

- Conversion rate by landing page type (MOFU vs BOFU).

- Form submits, calls, demo requests, quote requests.

- Quality (what leadership cares about)

- Lead-to-opportunity rate, win rate, average deal size, sales cycle length.

- Segment performance by region (APAC vs US vs Europe).

- Efficiency (budget justification)

- Paid-vs-organic gap: identify high-CPC clusters where organic coverage could reduce dependency over time.

A simple 30-day action plan (listicle)

- Pick 3 to 5 clusters with the strongest buyer intent signals.

- Audit the target BOFU pages for crawlability, speed, structure, and schema.

- Publish or upgrade 2 MOFU assets per cluster (comparison, "best," use-case pages).

- Add internal links from existing traffic-heavy pages to BOFU pages.

- Review results monthly, double down on clusters that generate qualified leads, deprioritize those that only generate traffic.

Get a free audit report

If you want a second opinion on which keywords are truly high-commercial-value for your site, share your domain with SeekLab.io. We will map your buyer-intent opportunities to the technical and content actions most likely to impact growth, and deprioritize what is unlikely to move revenue. Contact us to get a free audit report and leave your website domain.