2026 Global B2B Hardware Search Behavior & Keyword Opportunity Report

Expert reviewed

1) What the 2026 search landscape means for B2B hardware teams

B2B hardware buying is now decisively search-led, and that changes what "good SEO" looks like for manufacturers, exporters, and large catalogs.

Here are the behavior shifts that matter most in 2026:

- Digital research comes before sales contact. Multiple studies show buyers complete 60 to 70 percent of research before speaking with sales, and search engines are a primary discovery channel.

- B2B eCommerce scale keeps rising, pulling procurement online. By 2026, global B2B eCommerce is projected to exceed $36T, reinforcing buyer expectations for self-serve research and clear product documentation.

- Hardware search is specification-led, not volume-led. Engineers and procurement rarely search generic terms when a project is real. They search with standards, tolerances, pressure class, voltage, certifications, and application context. Volumes are smaller, but intent is high.

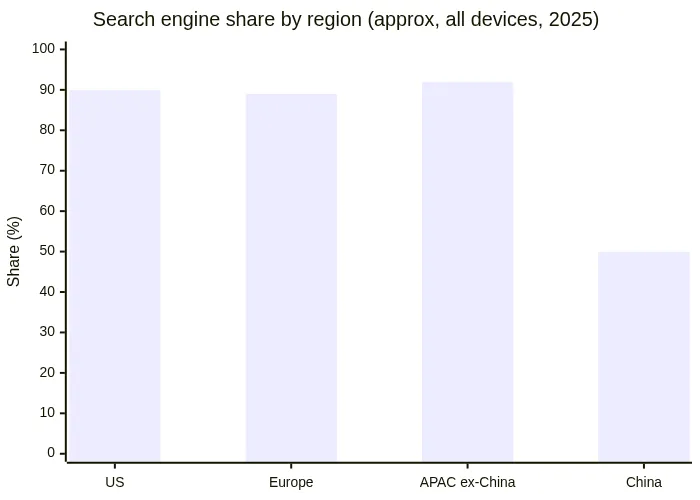

- Google dominates most regions, but your strategy still needs regional nuance. Global search engine market share remains heavily concentrated in Google, while China requires a different approach due to Baidu dominance and ecosystem constraints.

To make this concrete, here is a simplified view of regional search engine dominance used in many planning discussions:

Actionable takeaway: for B2B hardware, the winning move is rarely "publish more." It is to prioritize the intent clusters that drive RFQs, then ensure the site can actually be crawled, indexed, and understood at scale.

2) How B2B hardware buyers search: the intent patterns you can actually plan around

Across industrial and hardware categories, search demand clusters into four intent types:

- Informational (learn and troubleshoot): sizing, selection, failure modes, installation issues.

- Commercial (compare and shortlist): manufacturer lists, best options, technology comparisons.

- Navigational (brand/site): buyers searching specific manufacturers, standards bodies, known distributors.

- Transactional (RFQ/purchase-oriented): supplier, manufacturer, distributor, stockist, MOQ, lead time, compliance.

The important nuance: transactional intent often hides in long-tail queries. A single long-tail query can be worth more than thousands of broad clicks.

Below is a planning-friendly mapping you can use as a listicle-style checklist for content and page types:

| Buyer goal | Common query structure (examples) | Typical page format that wins | Why it wins in hardware |

|---|---|---|---|

| Learn basics | "how to size control valve", "string inverter vs microinverter commercial" | Technical guide with diagrams, tables, FAQs | Builds trust early and earns links |

| Shortlist suppliers | "API 610 centrifugal pump manufacturers", "utility scale solar racking manufacturer" | Comparison pages, capability pages, standards pages | Helps buyers reduce risk |

| Validate compliance | "UL 508A control panel shop", "EN 1090 steel structures supplier" | Certification hub + product family pages | Compliance is a gating factor |

| Buy or RFQ | "OEM wiring harness manufacturer low MOQ", "pallet racking manufacturer Texas" | Location or region landing pages, RFQ-ready category pages | Matches transactional intent and local modifiers |

If you run a hardware catalog, this is the strategic filter: do your highest-value pages answer the buying questions buyers actually search (certifications, lead time, trade terms, applications), or are they just listing SKUs?

3) Regional behavior differences (APAC, US, Europe, Middle East) that create keyword opportunity

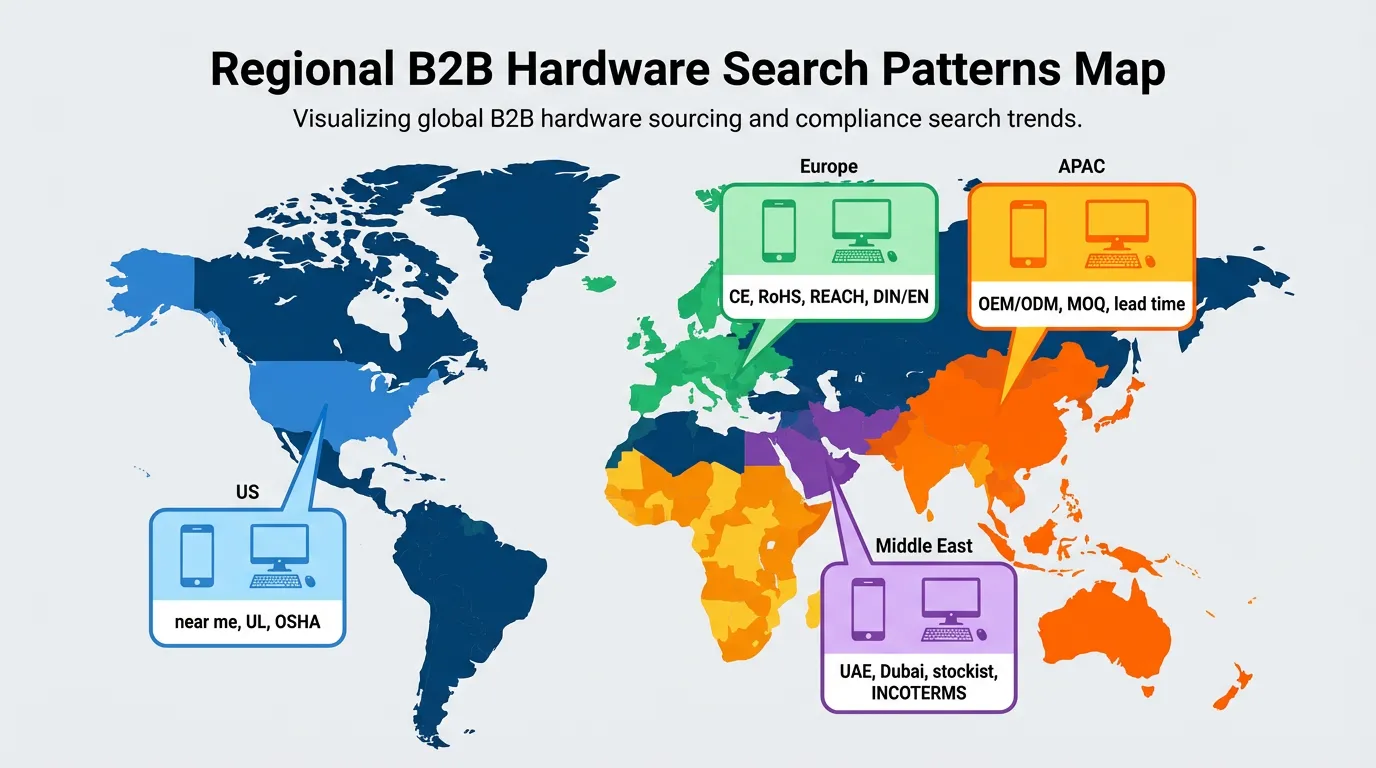

Hardware SEO becomes much easier when you stop treating "global" as one audience. The report highlights distinct patterns by region:

A practical regional planning table

| Region | Typical search modifiers | Device reality | What to emphasize on-page |

|---|---|---|---|

| APAC (ex-China) | "OEM", "ODM", "factory", "MOQ", "FOB price", "lead time" | Mobile-heavy discovery, desktop for spec review | Mobile speed, clear trade terms, bilingual structure |

| US | "manufacturer", "supplier", "distributor", "near me", state/city, "UL", "OSHA" | Desktop still strong for engineers | Local and compliance pages, downloadable spec assets |

| Europe | "CE", "RoHS", "REACH", "DIN", "EN", country language terms | Documentation-heavy evaluation | Standards-first content, localized language pages |

| Middle East (Dubai hub) | "UAE", "Dubai", "stockist", city terms, shipping terms | Mixed, high mobile usage in emerging markets | Stock and lead time clarity, INCOTERMS context |

Planning tip for exporters: create content that mirrors how buyers write queries, such as combining product terms with certifications, MOQ, lead time, and shipping terms. These combinations are exactly where high-intent, lower-competition opportunity tends to live.

4) The biggest technical SEO gaps we see in hardware catalogs (and how to prioritize fixes)

Most B2B hardware sites do not lose rankings because the team is not working hard. They lose rankings because the site becomes too complex for search engines to crawl and understand efficiently.

Based on common audit patterns cited in manufacturing SEO research and the report synthesis, the recurring technical issues are:

- Faceted navigation creates infinite URL combinations. Filters like size, material, voltage, pressure class can explode into thousands of near-duplicate URLs.

- Duplicate content across series, variants, and region pages. This dilutes relevance and can cause index bloat.

- Core Web Vitals failures on spec-heavy pages. Large images, PDFs, CAD viewers, and heavy scripts slow rendering and increase abandonment.

- Indexing mismatches: important category pages are not indexed, while thin parameter pages are indexable.

- Internationalization mistakes: misconfigured hreflang, wrong region pages ranking in the wrong countries.

A prioritization checklist (what to fix first, not everything)

The fastest-growth approach is not "fix everything." It is to focus on what truly impacts growth and what can be deprioritized.

| Priority | Fix category | What to check | Why it impacts revenue |

|---|---|---|---|

| P0 | Crawlability and indexation | Are money categories and top product families indexed? Are parameter URLs consuming crawl budget? | If Google cannot reliably reach core pages, content cannot win |

| P0 | Page performance | Are spec tables usable on mobile? Are heavy assets delaying LCP? | Hardware buyers bounce when pages are slow, especially on mobile discovery |

| P1 | Canonicals and duplication control | Do variants consolidate properly? Are series pages outranking thin SKUs? | Consolidation improves ranking stability for high-intent terms |

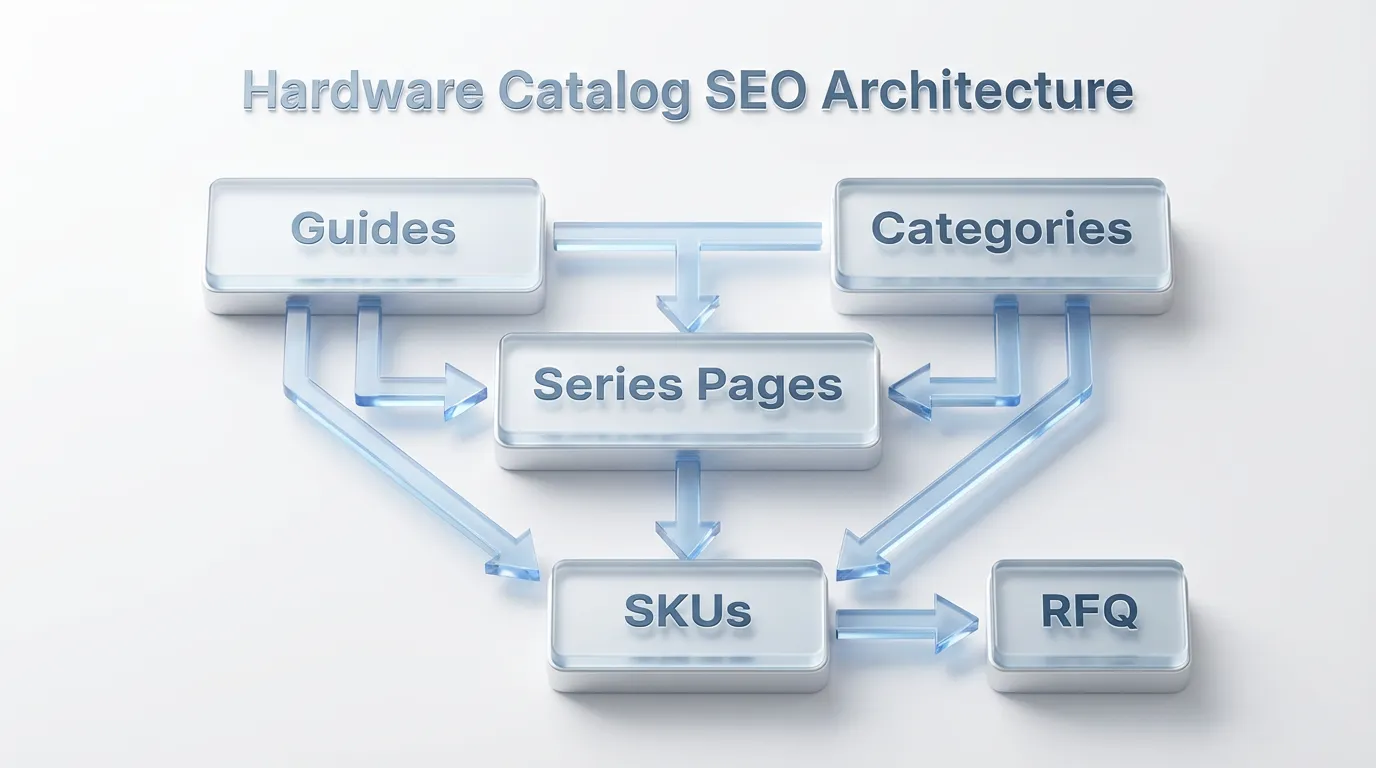

| P1 | Internal linking structure | Do guides link to categories and series pages consistently? | Links shape discovery, authority flow, and RFQ pathways |

| P2 | Structured data and documentation | Are Organization, Product (for key families), TechArticle, HowTo, FAQPage applied to high-quality pages? | Helps eligibility for richer results and clearer interpretation |

This is where SeekLab.io typically provides the most leverage: a comprehensive audit that combines crawling, rendering and JavaScript checks, page performance diagnostics, internal linking and semantic structure review, schema compliance, and international SEO validation, then turns it into an actionable plan.

5) 15 keyword opportunities to build a 2026 B2B hardware content roadmap (with page formats)

Below is a practical listicle you can adapt into a roadmap. It is intentionally built around the report's core insight: spec-driven, certification-driven, and supplier-evaluation queries convert.

Opportunity cluster A: Spec and standards-led supplier searches (high commercial and transactional intent)

- "[standard] [product] manufacturer" pages

Example patterns: API, DIN, EN, UL, ISO combined with product family.

Best format: standards hub + category pages with compliance callouts. - "manufacturer + region" landing pages

Example patterns: state, country, "UAE", "Germany", "Texas".

Best format: region page that lists capabilities, certifications, lead time, and RFQ path. - "ISO certified + [product] supplier" content

Best format: certification pages that link to relevant product families. - "stockist/distributor + lead time" content for electronics

Best format: availability and logistics documentation plus category structure.

Opportunity cluster B: Selection guides that feed RFQs (informational that becomes commercial)

- "how to choose/select" guides for industrial components

Best format: TechArticle-style guide with decision table, failure modes, and recommended spec checklist. - "comparison" pages for engineering tradeoffs

Example: "CNC vs casting for pump impeller".

Best format: comparison with application-specific recommendations. - "sizing" guides

Best format: step-by-step guide plus downloadable checklist for RFQ requirements.

Opportunity cluster C: Cross-border exporter modifiers (especially APAC to US, EU, Middle East)

- "OEM vs ODM" explanation pages mapped to your business model

Best format: clear definitions + how buyers should request quotes. - "MOQ" and "lead time" transparency pages

Best format: FAQ + category pages with typical ranges and variables that affect lead time. - "FOB/CIF + port" content for buyer confidence

Best format: logistics explainer page linked from high-intent categories.

Opportunity cluster D: Post-purchase troubleshooting that builds trust (and reduces churn)

- "error code" troubleshooting pages (renewables, electronics)

Best format: HowTo steps, images, safety notes, and escalation path. - "failure causes" content (racking safety, manufacturing defects)

Best format: technical guide with inspection checklist.

Opportunity cluster E: Catalog SEO topics that win in competitive SERPs

- Faceted navigation, canonicals, and parameter handling guidance

Best format: practical guide that includes examples for spec filters. - Core Web Vitals fixes for spec-heavy pages

Best format: performance playbook for images, tables, PDFs, and heavy scripts. - International and hreflang governance for multi-region catalogs

Best format: decision framework for single-site vs multi-site, plus validation checklist.

What to publish first (a simple sequencing rule)

If you need a non-negotiable starting point, sequence like this:

- Fix indexing and performance on your highest-converting categories.

- Publish 3 to 5 selection guides that link directly into those categories and series pages.

- Add certification and standards hubs that reduce buyer risk.

- Expand region and exporter pages only after the core architecture is stable.

Next step: turn this report into an audit-backed plan (not guesswork)

If you are a manufacturer, exporter, or operator of a large hardware catalog, the highest ROI move is to validate two things before writing more content:

- Can search engines efficiently crawl and index the pages that matter most?

- Do your pages reflect the real buyer questions: specs, standards, certifications, lead time, MOQ, and trade terms?

SeekLab.io focuses on identifying what truly impacts growth and what can be deprioritized, then providing clear, actionable solutions and technical guidance across content and technical SEO.

Get a free audit report, contact us, and leave your website domain.