Global Search Demand by Country: A 2026 Market Entry Intelligence Report

Expert reviewed

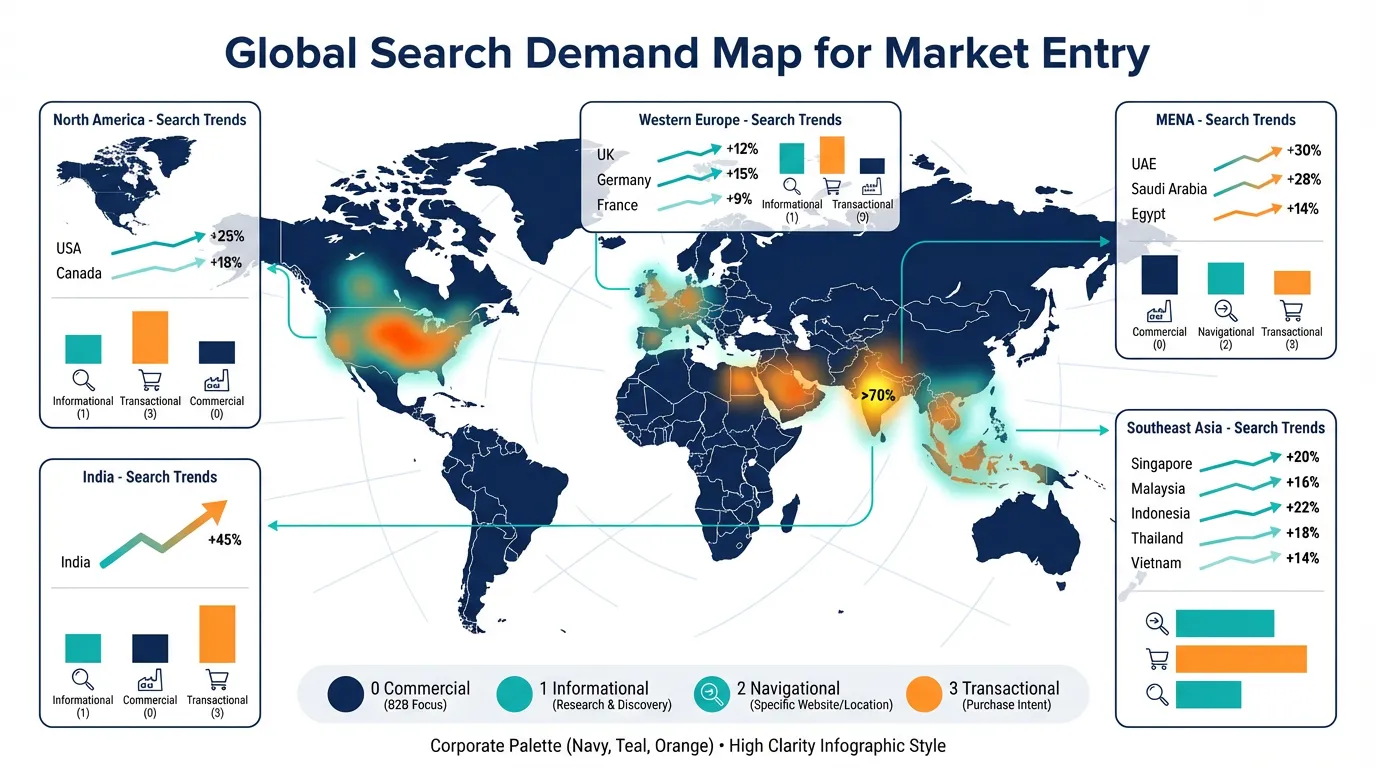

Search-led expansion is getting less forgiving in 2026. Global demand is not just about total volume anymore. It is about where demand concentrates, which search engines actually matter in that country, and how much of that demand signals buyer readiness (commercial and transactional intent) vs early-stage learning.

Below is a practical, list-style market entry playbook you can use to turn global search demand by country into decisions your marketing and operations teams can execute.

Why global search demand by country is now a market entry KPI (not just a SEO metric)

Use country-level search data as a pre-commitment filter before you spend on localization, distributors, or new site builds.

What changed going into 2026:

- Google dominates globally, but not universally. Google is still roughly 90 percent of global search share across devices, but China, Russia, and South Korea have strong local leaders that change your technical and content approach.

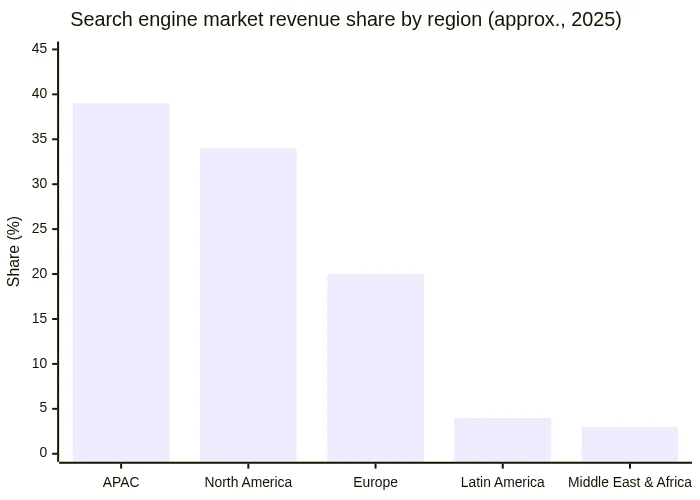

- APAC is the revenue and growth engine, Europe is e-commerce-ready. APAC holds about 38 to 39 percent of global search engine market revenue share, while Europe dominates top rankings for B2C e-commerce readiness (with Singapore as a leading APAC exception).

- Buyer readiness shows up in intent mix. Mature markets tend to generate more commercial (0) and transactional (3) patterns for many B2B categories, while high-growth markets often start with more informational (1) discovery, then quickly ramp to transactional behavior as digital commerce matures (directional insight based on SERP patterns and readiness indicators).

If you are an exporter or a multi-country B2B site, this is the difference between:

- ranking for content that looks successful in analytics but does not convert, and

- building a country roadmap that aligns traffic with actual pipeline.

The 6-step checklist to turn international market search demand into a country shortlist

1) Identify the real search engine landscape per country (before you talk keywords)

Start by answering: do you have a "Google-first" market, or a "local-engine" market?

- Google-first: US, most of Europe, India, Southeast Asia, much of LATAM.

- Local-engine-sensitive:

- China: Baidu leads, Google is largely absent.

- Russia: Yandex is dominant.

- South Korea: Naver is a major player.

Operational implication: your technical SEO audit scope changes immediately (rendering, crawling behavior, structured data expectations, and sometimes hosting and compliance constraints).

2) Build a country seed list from demand signals, not internal opinions

Use three inputs to form a realistic candidate list:

- Existing leads by country (CRM + form submissions).

- Existing organic impressions by country (Search Console).

- Commercial reality (where you can actually price, ship, support, and close).

Then validate demand with keyword tools (country database selection matters).

3) Classify keywords by intent codes (0 to 3) so you do not confuse "interest" with "readiness"

A simple way to avoid false positives is to force every cluster into one dominant intent bucket:

| Intent code | What it means | Typical modifiers | What to build |

|---|---|---|---|

| 0 | Commercial | best, top, agency, services, comparison | solution pages, comparison pages, case-study hubs |

| 1 | Informational | how, what is, guide, requirements | guides, playbooks, checklists, FAQs |

| 2 | Navigational | brand, login, pricing page name | brand protection pages, localized brand SERP coverage |

| 3 | Transactional | buy, price, quote, supplier, distributor | quote flows, distributor pages, product landing pages |

This step is where many teams waste budgets: they see volume (often informational) and assume it will convert.

4) Add an e-commerce readiness layer to interpret conversion odds

Search demand alone is not market size. But it is a strong proxy for digital buying behavior when combined with readiness indicators.

UNCTAD's B2C E-commerce Index is useful because it reflects fundamentals like internet usage, payment access, secure servers, and postal reliability. References: UNCTAD index intro, UNCTAD ranking.

Here is an approximate "top readiness" snapshot frequently cited from UNCTAD tables and summaries (values are directional, not a live scorecard):

| High-readiness countries (examples) | Why they matter for SEO-led entry |

|---|---|

| Netherlands, Switzerland, UK, Germany, Nordics | High likelihood that commercial pages and quote flows convert |

| Singapore | High readiness in APAC, strong cross-border and B2B activity |

| Australia | Strong English-market expansion target with high digital maturity |

Supporting reference tables: UNCTAD B2C index data (XLS), UNCTAD B2C table (document source).

5) Score countries with a simple "enter, nurture, park" model

Keep it lightweight so it can survive internal debates.

| Score component | How to grade | What "good" looks like |

|---|---|---|

| Demand index | Low / Medium / High | Medium+ demand in core money clusters |

| Intent skew | Mostly 1 vs balanced 0 and 3 | Enough 0 and 3 keywords to justify sales pages |

| SERP competitiveness | Low / Medium / High | Medium or lower for initial entry, or high with a long-term plan |

| Operational fit | Not ready / partially / ready | pricing, shipping, support, compliance are feasible |

Output:

- Enter now: balanced intent, medium+ demand, operational readiness.

- Nurture: demand exists but heavily informational, build education and authority first.

- Park: low demand, or high friction markets, revisit annually.

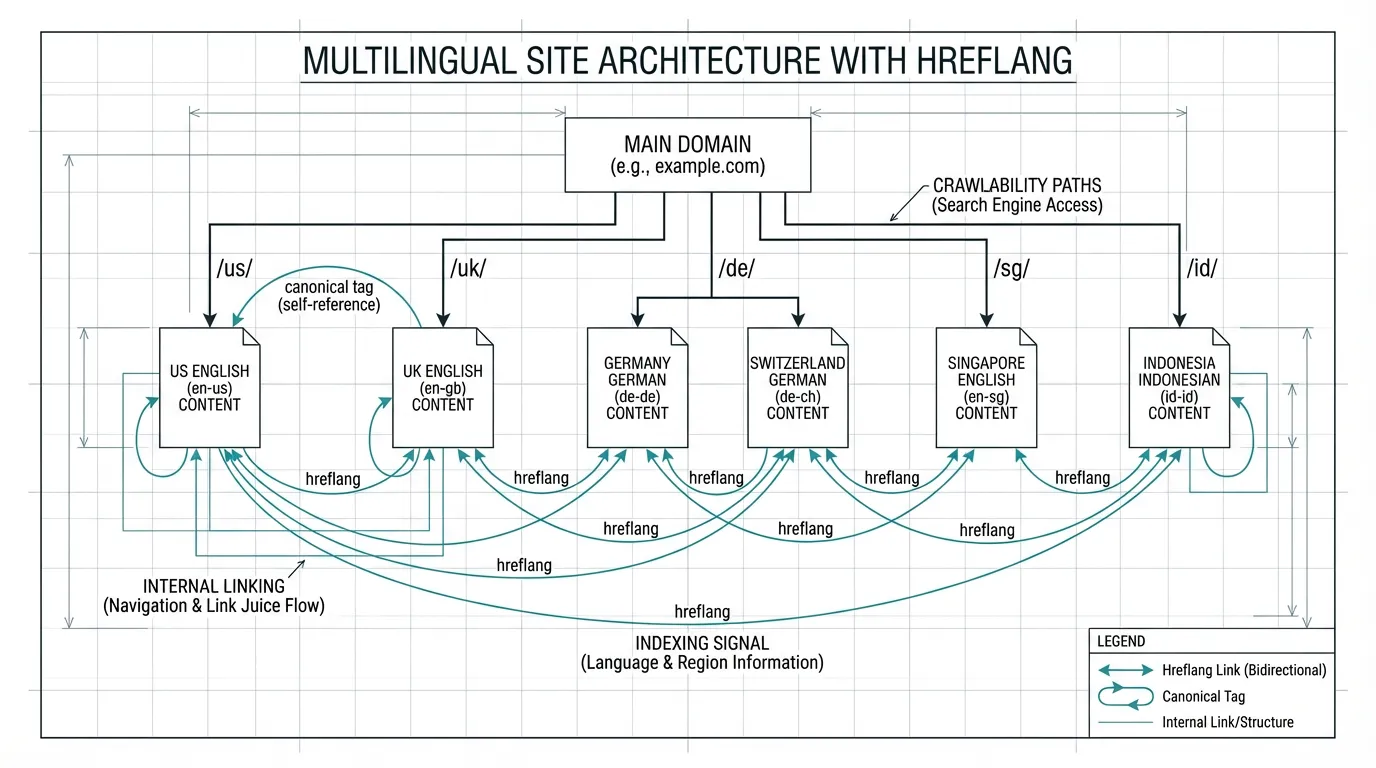

6) Convert the shortlist into a SEO architecture decision, not just a content queue

Your country choice determines:

- whether you need subfolders vs ccTLDs,

- how complex hreflang SEO becomes,

- how internal linking equity should be distributed,

- and whether Core Web Vitals constraints will block growth in mobile-first regions.

This is where a full-site crawl and structured analysis typically pays for itself: it reveals what truly impacts growth vs what can be deprioritized.

10 country and region picks to consider in 2026 (with the "why" behind each)

Use this as a starting list, then replace with your own data.

- United States: high competition, but strong commercial and transactional intent for both B2B services and e-commerce categories.

- UK: mature buyers, strong intent depth, and high readiness.

- Germany: consistently strong B2B purchase research behavior; localization quality matters.

- Netherlands: small but high-value, very strong e-commerce readiness signal (often good for cross-border suppliers).

- Switzerland: high readiness and high intent value; expect fewer but higher-quality leads.

- Singapore: top-tier readiness in APAC and a regional hub for B2B evaluation.

- Australia: high readiness, English-market leverage, solid expansion stepping stone.

- India: massive volume, often more informational early, but growing fast in commercial and transactional behavior; strong for nurture-to-convert strategies.

- Indonesia / Vietnam / Thailand / Philippines (pick based on your niche): mobile-first growth markets; win with performance + localized buyer education. Regional context: Google, Temasek, Bain e-Conomy SEA.

- UAE / Saudi Arabia: MENA leaders with strong commercial intent in many categories; bilingual requirements matter.

Two "special handling" markets:

- China: Baidu-first reality changes technical requirements.

- Russia: Yandex dominance changes SERP dynamics and sometimes compliance constraints.

What the macro numbers say about where competition will intensify

The strategic point is not the exact number. It is the trajectory: search and SEO investment are still climbing, so "basic optimization" will not hold the line in 2026.

Regional share of search engine market revenue (approximate)

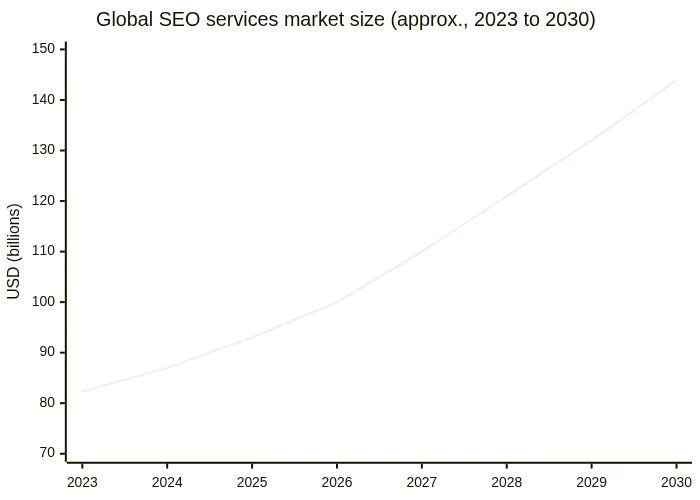

Global SEO services market growth (directional)

Intermediate values are interpolated for readability, not precise forecasts.

Technical and content priorities by region (so your rankings can actually convert)

Use this as a deployment checklist once you have a target market tier.

APAC (especially India and Southeast Asia)

- Technical: Core Web Vitals SEO is non-negotiable in mobile-first environments, and heavy JavaScript can break rendering and performance on mid-range devices.

- Architecture: plan multilingual and multi-country structure early (hreflang SEO plus canonical tag SEO) to avoid duplication and cannibalization later.

- Content: lead with informational (1) content tied to real workflows, then layer commercial (0) pages once you see query patterns shifting.

United States and Canada

- Technical: expect advanced technical SEO audit findings (crawl budget waste, parameter traps, schema markup SEO gaps, indexing conflicts).

- Content: mature SERPs punish generic writing. Publish fewer pages, but make them decision-grade (use cases, constraints, FAQs that match buyer objections).

Europe (UK, Germany, Netherlands, Nordics)

- Technical: multilingual variants (language-country pairs like de-DE vs de-CH) require precise hreflang governance and internal linking strategy.

- Content: localized proof and terminology matter. Users are often ready to act, but they verify credibility before converting.

MENA (UAE, Saudi Arabia)

- Technical: bilingual experiences often require careful template logic, right-to-left handling for Arabic layouts, and performance discipline on mobile.

- Content: add local terminology variants and transliterations into your keyword research to capture real buyer phrasing, not just English.

How SeekLab.io helps you act on global buyer demand analysis (without wasting budget)

If you are worried about paying for SEO work that does not translate into leads, the practical safeguard is a workflow that prioritizes impact over activity:

- Start with a full technical SEO audit and structured crawling analysis. This surfaces what truly blocks growth (indexing, rendering, performance, architecture) and what can be deprioritized.

- Convert country-level search trends into a market entry keyword research map. You should see, per country, how much demand sits in informational (1) vs commercial (0) and transactional (3).

- Build a phased roadmap that ties content to operations. For example, do not scale transactional landing pages in a country where logistics, pricing, or support is not ready.

- Measure success in qualified inquiries, not just rankings. Monthly reviews should answer: which countries produce leads that sales can close, and where do prospects drop due to missing documentation, unclear lead times, or weak trust signals.

If you want to validate your market shortlist quickly: get a free audit report, contact us, and leave your website domain.